March 26, 2020

As closures and service limits take effect, the financial impact becomes clearer

The third wave of the Jobson Optical Research survey measuring trends and attitudes on coronavirus showed that the closings and concern have created considerable personal and business-related stress among the 1,295 respondents. In a new question asking respondents to rate their personal level of stress on a 10-point scale with 1 as lowest and 10 as highest, about 56 percent rated their stress level at 7 or higher.  One startling change was that during the March 18-19 survey, none of the respondents said that they had closed their practices; in the March 23-24 survey, 59 percent said they had closed their practices. Forty-one percent of the respondents have said that they had to lay off staff. Of those, 41 percent said they laid off the entire staff, and 30 percent said they have laid off about three-quarters of their staff. Only 24 percent of the respondents said that there are opportunities for staff to work from home.

One startling change was that during the March 18-19 survey, none of the respondents said that they had closed their practices; in the March 23-24 survey, 59 percent said they had closed their practices. Forty-one percent of the respondents have said that they had to lay off staff. Of those, 41 percent said they laid off the entire staff, and 30 percent said they have laid off about three-quarters of their staff. Only 24 percent of the respondents said that there are opportunities for staff to work from home.

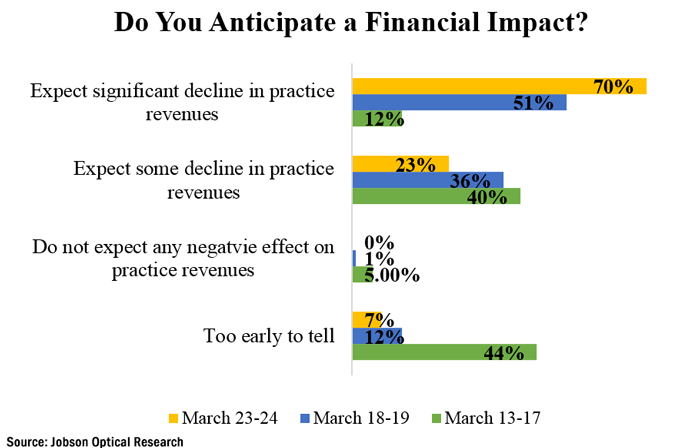

Interest in telemedicine services continues to increase, as respondents see this greater opportunities in serving patients in ways other than traditional office visits. In the first wave of the survey from March 13-16, only 17 percent said they planned to offer telemedicine in the near future and five percent said they had already started to offer it. By this third survey wave, nearly 31 percent said they planned to offer it and 13 percent said they already were. Patient interest in telemedicine services also seem to be rising, according to respondents. In the first wave, only 17 percent said that coronavirus concerns have influenced patients’ interest in telehealth service, but by the third wave, that was up to 30 percent. Those who are offering telehealth services are offering phone based consultations (83%), video/image consultations (75 percent) and mobile telehealth apps (19 percent). Twenty-six percent of the respondents said that they have been able to bill for telehealth services in the past two weeks.  As closings and service limitations are taking effect, respondents are recognizing the financial impact more accurately. In this third wave of survey responses, 69 percent of respondents expect a significant decline in practice revenues, compared to 51 percent in the second wave and 12 percent in the first wave. Sixty-one percent of the respondents were optometrists, with 63 percent of them working in a single-location practice; 57 percent also said that they were than an owner or decision-maker in terms of limiting access or closing locations. Fifty-seven percent of the respondents were women.

As closings and service limitations are taking effect, respondents are recognizing the financial impact more accurately. In this third wave of survey responses, 69 percent of respondents expect a significant decline in practice revenues, compared to 51 percent in the second wave and 12 percent in the first wave. Sixty-one percent of the respondents were optometrists, with 63 percent of them working in a single-location practice; 57 percent also said that they were than an owner or decision-maker in terms of limiting access or closing locations. Fifty-seven percent of the respondents were women.